ADT Inc. (ADT) recently reported Q4 2018 and full year earnings on March 11, 2019. The company reported a loss on GAAP basis, missed consensus estimates of $0.13 per share and provided weak EBITDA guidance. The stock price fell over 15% in response and is now testing its lows. Notably, the stock price is down over 55% from its IPO price in January 2018.

In my earlier article I wrote about how the company was making the right moves and was undervalued. But I identified the main risk, as the company's return to profitability takes longer than expected. In fact, based on Q4 2018 earnings, that is largely what happened. However, I still believe that ADT continues to make the right moves and is undervalued despite the poor reception by the market on the recent earnings release.

Overall the company is experiencing revenue growth organically and through acquisitions. ADT is also improving on many core operational metrics. In addition, a key development occurred one week after the earnings release when the company announced that a tender offer and conditional notice of redemption for up to $2,246M of the 9.25% Second Priority Senior Secured Notes due in 2023. The debt refinancing will lower interest expense by a meaningful amount and push maturities out by several years. The company is now better positioned for growth and return to sustained profitability without the overhang of significant debt maturities. In this article I discuss how ADT's actions will lead the company back to profitability. I also provide valuation estimates that show the company is likely undervalued and there is a 56% - 71% upside.

Source: adt.com

Source: adt.com

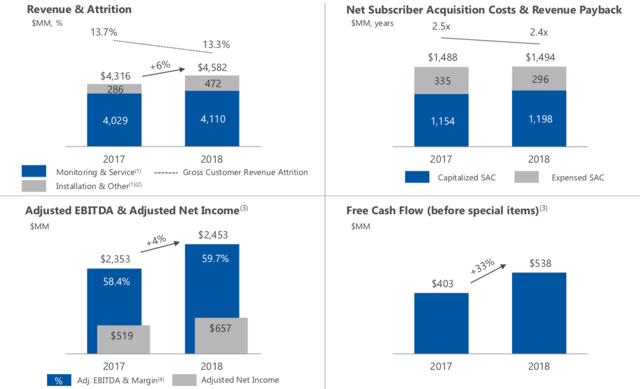

ADT is performing well from an operational perspective since its IPO. Revenue increased by 6% to $4,482M in 2018 from $4,316M in 2017 as seen in the chart below. Sales benefitted from higher monitoring & service revenue and higher installation revenue. This led to a 4% increase in adjusted EBITDA to $2,453M in 2018 from $2,353M in 2017. Adjusted net income also increased to $657M in 2018 from $519M in 2017. Furthermore, attrition continues its downward trend decreasing from 13.7% in 2017 to 13.3% in 2018. The company is also becoming more efficient in acquiring customers and the customer revenue payback metric is down to 2.4X in 2018 from 2.5X in 2017. A decline of 0.1X represents roughly $60M in annual savings. Free cash flow also increased 33% before special items. But notably, diluted EPS was down and showed a loss of ($0.81) in 2018 from a profit of $0.53 in 2017.

ADT 2018 Selected Financial and Operational Metrics

Source: ADT Q4 2018 Earnings Presentation

Source: ADT Q4 2018 Earnings Presentation

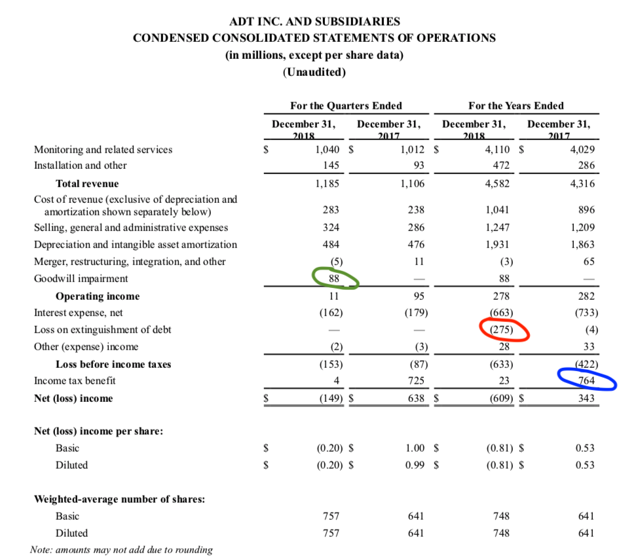

Let's examine ADT's consolidated statement of operations, see below, and see how they impacted earnings. Three one time items stand out that are (1) the loss on extinguishment of debt in 2018 (circled in red), (2) income tax benefit in 2017 (circled in blue) and (3) goodwill impairment (circled in green). In 2018, ADT redeemed $750M in preferred notes early in 2018. This action has a future benefit of reducing cash flow requirements. But at the same time ADT had to pay a redemption premium and accumulated dividend of $213M to extinguish this debt. This is a large amount relative to the value of preferred notes and negatively impacted earnings in 2018. The company also needed to pay a call premium and write-off a portion of the unamortized deferred financing costs of $63M for the redeemed $594M of Second Priority Senior Secured Notes (Second Lien Notes). This too was a large amount. In 2018, the total cost for early redemption was $275M, which was an expense not present in 2017.

In 2017, ADT received a tax benefit of $764M due to the U.S Tax Cut and Jobs Act. This was not present in 2018. The full year 2018 results were also impacted by $88M in good will impairment (circled in green) related to the Canada reporting unit. This impairment loss was not present in 2017 and accounted for about ($0.12) loss in Q4 2018. After accounting for special items ADT showed an improvement on year-over-year basis as the loss went from ($0.35) in 2017 to ($0.16) in 2018.

Source: ADT Q4 2018 And 2018 Full Year Earnings Release

Source: ADT Q4 2018 And 2018 Full Year Earnings Release

It is likely that special items will impact ADT's earning in 2019 but the dollar value will be lower than in 2018. The company is aggressively paying down the Second Lien Notes and there will be a redemption premium associated with this action. The company already redeemed $300M of notes and paid $19M in premium. ADT is redeeming $1,000M of the remaining $2,246 Second Lien Notes. This will likely have a repayment premium of roughly $60M using the earlier repayment as a benchmark. So losses from debt extinguishment totals approximately $79M to date, a large number, but still almost $200M less than in 2018.

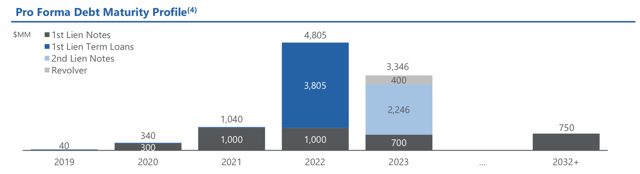

Debt Refinancing Will Reduce Interest ExpenseIn addition to redeeming $1,000M of the remaining $2,246 Second Lien Notes, the company will repay off $500M of outstanding term loans. The redeemed debt will be replaced with $750M in 5.25% First Priority Senior Secured Notes due in 2024 and 5.75% First Priority Senior Secured Notes due in 2026. This has the effect of pushing out existing debt maturities in 2022 and 2023. The chart below shows the debt maturities at end of 2018 and already excludes the $300M repayment of part of the Second Lien. The large cash flow requirement in 2022 will be reduced by $500M. Notably, the term loan notes are floating rate as it is indexed to LIBOR + 2.75% (roughly 5.6% using the 1-year LIBOR). The cash flow requirements in 2023 will be reduced by $1,000M and this debt has a 9.25% rate.

ADT Pro Forma Debt Maturity Profile At End of 2018

Source: ADT Q4 2018 Earnings Presentation

Source: ADT Q4 2018 Earnings Presentation

In addition to pushing maturities out, the large debt repayments will lead to significantly lower interest expense in 2019. In 2017, interest expense was $733M and this dropped to $663M in 2018. Actions this year will further reduce interest expense. The $300M redemption of the 9.25% notes will lower interest expense by another $28M. The redemption of $1,000M of 9.25% notes and reissue at $750M of 5.25% notes and $250M of 5.75% notes will reduce interest rates by almost $39M. However, there is no interest expense savings on replacing the floating rate term loans with 5.75% notes. Hence, ADT should save about $67M in interest expense in 2019 relative to 2018.

Will ADT Be Profitable In 2019?ADT provided total revenue guidance of $4,900M - $5,100M representing an increase of 6% - 11% through a combination of growth in monitoring and service and commercial expansion. The company is forecasting flat customer acquisition costs compared with 2018 and lower customer attrition to 13.2% - 12.8%. But saying that, the company did not provide an earnings estimate for 2019.

Let's use their total revenue estimates and my above estimate for losses due to debt extinguishment and reduction in interest expenses to see if ADT will be profitable in 2019. In 2019, we assume costs will remain flattish to slightly increasing with 2018, no merger related costs and no goodwill impairment. We also assume no income tax benefit for simplicity. We assume no change in the number of diluted shares. We use the low end of the total revenue range provided by ADT as the bearish case, the high end of the range as the bullish case and the midpoint as base case.

Bearish, Base and Bullish Earnings Estimates for ADT in 2019

Bearish | Base | Bullish | |

Total Revenue | $4,900 | $5,000 | $5,100 |

Cost of Revenue | $1,050 | $1,050 | $1,050 |

Selling, general and administrative expenses | $1,250 | $1,250 | $1,250 |

Depreciation and intangible asset amortization | $1,950 | $1,950 | $1,950 |

Merger, restructuring, integration, and other | -- | -- | -- |

Goodwill impairment | -- | -- | -- |

Operating Income | $650 | $750 | $850 |

Interest Expense, net | ($596) | ($596) | ($596) |

Loss on extinguishment of debt | ($79) | ($79) | ($79) |

Other (expense) income | $15 | $15 | $15 |

Loss Before Income Taxes | ($10) | $90 | $190 |

Income tax benefit | -- | -- | -- |

Net (loss) income | ($10) | $90 | $190 |

Net (loss) income per share | |||

Diluted | ($0.01) | $0.12 | $0.25 |

Weighted-average number of shares | |||

Diluted | 748 | 748 | 748 |

Source: Dividend Power Calculations and data from ADT Q4 2018 And 2018 Full Year Earnings Release

One can see that there is a wide range of outcomes from a slight loss in the bearish case to a decent profit per share in the bullish case. Debt extinguishment and high interest expenses are still affecting ADT. After subtracting out expenses related to extinguishment of debt then the company earns $0.09 to $0.36 per share. Even though interest expenses are falling, they are still high for a company the size of ADT.

Notably, even my bullish earnings estimates in 2019 are lower than the consensus estimates provided in Seeking Alpha of $0.85 - $0.95. I believe that my estimates are conservative and I have accounted for lack of current profitability, time needed to de-lever, and the short time since the IPO and the lack of EPS guidance from ADT's management.

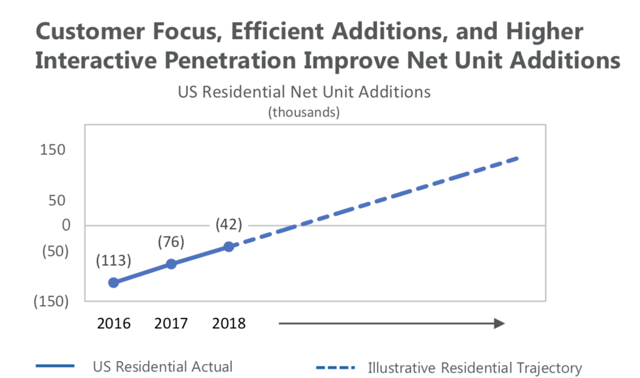

RisksI see 2019 as a transition year as ADT expands in the commercial sector. The main risk here is that the company cannot execute well and the return to profitability gets pushed into 2020. The company's Canadian operations continue to be drag on revenue. Hence, ADT took goodwill impairment in 2018 negatively impacting profitability. The company has not yet outlined steps to either turn around revenue growth or divest the Canadian unit. The U.S. Residential business was losing customers but the attrition rate is slowly decreasing due to customer service improvements and increased penetration of ADT Pulse. The chart below shows the improvement. The company must add customers instead of relying only on price increases to generate revenue growth for this part of the business. ADT's focus on the next generation ADT Command and Control product and the recent acquisition of LifeShield for the do-it-yourself market should help in this regard.

Source: ADT Q4 2018 Earnings Presentation

Source: ADT Q4 2018 Earnings Presentation

Valuing a non-profitable and highly leveraged company is a difficult exercise. Since the company is not profitable and future earnings are uncertain I have now decided to use a multiple based on revenue. A close competitor to ADT is Alarm.com Holdings Inc. (ALRM), which had total revenue in 2018 of $420.5M and currently has a market capitalization of $2.97B giving it a multiple of ~7.0X. But Alarm.com is profitable, has little debt and is growing revenue faster than ADT at a rate of roughly 20% in 2018 albeit off a lower revenue base. If we use a discounted multiple of 3.5X for ADT accounting for the slower revenue growth rate, lack of profitability and higher leverage then we get a value per share in the table below for the bearish case, base case, and bullish case.

ADT Valuation Estimate Based On Revenue Multiple Comps

Bearish | Base | Bullish | |

2019E Revenue | $4,900 | $5,000 | $5,100 |

Applicable Multiple | 3.5 | 3.5 | 3.5 |

EV | $17,150 | $17,500 | $17,850 |

Less: Net Debt | $9,926 | $9,926 | $9,926 |

Equity Value | $7,224 | $7,574 | $7,924 |

Shares Outstanding | 748 | 748 | 748 |

Value Per Share | $9.66 | $10.13 | $10.59 |

Upside from Current Price | 55.52% | 63.05% | 70.59% |

Source: Dividend Power calculations based on data in ADT Q4 2018 Earnings Presentation

Notably, this valuation is sensitive to the selected multiple. Below I show a sensitivity analysis for my readers who believe that a different discounted multiple is applicable. The main point here is that the stock is currently trading at a multiple roughly between 2.5X and 3.0X, which is significantly less than competitor Alarm.com.

ADT Valuation Sensitivity

Bearish | Base | Bullish | |

3.0X | $6.38 | $6.78 | $7.18 |

3.5X | $9.66 | $10.13 | $10.59 |

4.0X | $12.93 | $13.47 | $14.00 |

4.5X | $16.21 | $16.81 | $17.41 |

5.0X | $19.48 | $20.15 | $20.82 |

Source: Dividend Power calculations based on data in ADT Q4 2018 Earnings Presentation

The valuation estimates may well be low if ADT continues to grow revenue from organic growth and acquisitions over the next several years. I believe that if ADT is successful in commercial expansion and returns the U.S. Residential business to unit growth then valuations may be higher than I forecast. Furthermore, my valuation estimates does not even account from any upside in growth from the announced partnership with Amazon that lacks details or from future debt reductions.

Final ThoughtsAlthough the company is still heavily leveraged and not profitable, ADT is growing earning organically and through acquisitions, improving operational metrics, de-levering and reducing interest expenses. Based on my estimates the company will likely be profitable in 2019. But saying that, this remains a very competitive business and with ADT's debt load it must continue to execute well. However, the company has set the groundwork for future growth and profitability. Furthermore, ADT is undervalued and has a 56% - 71% upside, even after discounting the revenue multiple compared to a direct competitor by 50%. Hence, I am a buyer of this stock and have added to my position.

Disclosure: I am/we are long ADT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment