Highlights

- Weak Q3 is a blip; improving macros, better rural policy support a positive

- Animal feed segment stabilising post hiccups, margin to improve

- New products to boost growth in crop protection business

- Vegetable oil segment to benefit from new procurement price policy

- Value-added products to drive growth in dairy business

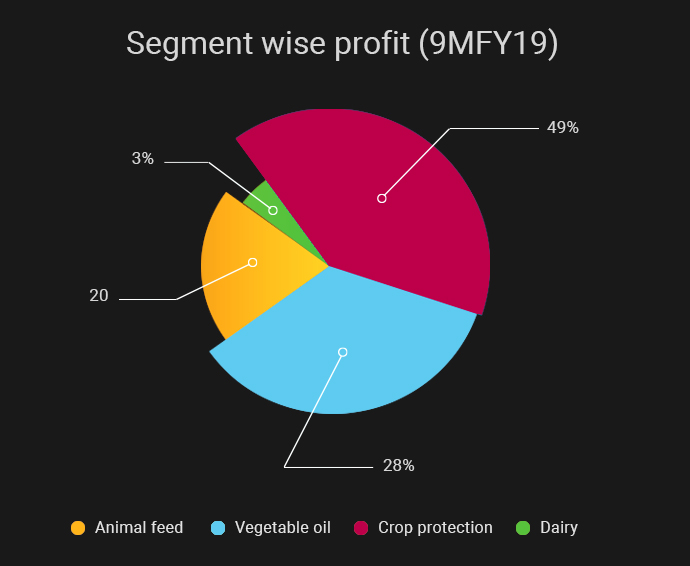

Godrej Agrovet is a diversified farm-to-fork arm of the Godrej group that has farm products businesses with operations across five major synergistic verticals.

Despite a strong volume growth, performance was soft in the December quarter due to a rise in raw material prices. The lag in price hikes led to margin tightening. That said, the weak third quarter show was a blip. Almost every segment of GAVL is expected to do better in the coming quarters.

The animal feed segment caters to low margin cattle, broiler, aqua and shrimp feed businesses. There was strong revenue and volume growth in Q3. However, margin contracted due to a sharp rise in key raw material across various feeds and because the company could not pass on these high costs to farmers, who were facing financial distress amid a poor monsoon and very low milk prices.

Several factors though have turned the outlook favourable. The company has now raised prices and the situation is likely to improve in the current (January-March) quarter. The segment's capital employed is going down, which is a positive, and the management expects this trend to continue. With the drought-like situation in many regions, milk production has gone down and prices are expected to improve. This is a positive for the cattle feed segment. The overhang in the aqua feed segment due to high input cost and low pricing power in the shrimp feed segment seems to be stabilising a bit.

The company has pared its raw material inventory levels to 15-20 days owing to volatile raw material prices, which is the case with competitors as well. This has made passing on costs easier and will boost/protect margin. GAVL's several R&D initiatives in the pipeline are also expected to benefit this segment in the long run.

Crop protection to drive marginHigher sales of traded products, coupled with limited price hikes, dented the segment's operating margin. A poor monsoon led to a strained cash position of farmers, increased receivables and accumulation of inventory in the market, which the company had to take back. This impacted performance. However, this inventory will be sold in the upcoming season.

The company has created Rs 5 crore provision for receivables which hit the segment's margins. However, the management indicated that recoveries have been on an upswing with substantial improvement in January.

The company has a healthy line-up of branded products in this high margin segment and has been investing in R&D to come up with new molecules, one of which is expected to be monetised in the current (January-March) quarter. To achieve rapid expansion, the management also indicated the possibility of inorganic expansion.

New pricing policy to benefit vegetable oil businessThe company's new palm oil mill in Chitampally is now fully operational and expected to boost volumes.

The government has reduced the import duty on palm oil. Due to this, the domestic market is open for competition from international players. The soft import policy for palm oil stands to negatively impact the segment.

The soft import policy for palm oil augurs well for international players who have a competitive advantage in the domestic market. The new CACP (Commission for Agriculture Cost and Pricing) is expected to come out with a uniform pricing policy for procurement of palm fruit bunches. Currently, the price varies from the state-wise. The company has split its procurement area between Andhra Pradesh (AP) and Telangana. Last season saw high price of fruit bunches in Telangana versus AP, as a result of which the procurement cost went up as many AP farmers sold their produce in Telangana.

GAVL has invested in new technology that would help in improving the oil extraction ratio from fruit bunches (from 17 to 18-18.5 percent).

Palm oil business is another high margin segment and the management indicated intentions of growing rapidly inorganically. The company had participated in the Ruchi Soya bidding and similar opportunities cannot be ruled out.

Dairy business recovering from the setbackDeclining butter prices along with a supply glut for butter dented this segment's profitability in the past few quarters. However, the situation is now turning favourable with the clearing-up of milk inventory. Moreover, the company is expanding the high margin value-added product portfolio with a few strategic launches. This is expected to improve profitability for the segment going forward.

Astec Lifesciences to be fully mergedExport business of Astec Lifesciences has been reporting healthy growth. The new plant for backward integration is now fully operational and margins are expected to improve further. R&D initiatives in the Nashik unit will also help in the long run. Plans to fully merge Astec (share ratio 11:10) are awaiting approvals.

OutlookGAVL's performance has admittedly been soft in the last two quarters. However, the company has the necessary strategic plans in place – including looking for acquisitions in the high margin crop protection and vegetable oil segments. The macro situation is also improving for the firm. It is one of the key beneficiaries of rising rural policy support. In effect, almost all segments are expected to improve performance as we have discussed earlier.

The GAVL stock has seen a noticeable correction after the management commentary after its result, taking it close to its listing price. It is now trading at 25 times estimated earnings for FY20. The long-term growth story for the company remains intact and we remain positive about the company's successful execution of segment-wise business strategies.

Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here First Published on Feb 18, 2019 03:06 pm

No comments:

Post a Comment